Here we share a Python version of our previous R worked example on using ML modelling on triangles, which we originally presented at the 2021 IFOA Spring Conference

Introduction

In this article we look at applying different machine learning (ML) models to a data set. Our goal is to illustrate a work flow for:

- setting up a data set for ML

- applying different ML models to this data

- tuning the ML hyper-parameters

- comparing and contrasting performance for the past fitted values and the future predictions.

A secondary goal is to demonstrate the utility of a multi-model machine learning framework which enables the user to easily “plug and play” different machine learning models within the same framework.

We use the scikit-learn in Python here. Followers of the blog may see significant similarities with the earlier mlr3 article for R users, except this article uses Python.

You can download a zipped version of this notebook here and run it on your local machine, or on a cloud service like Google Colab. If you are looking at such a downloaded copy, find the Machine Learning for Reserving blog here.

Who is this article aimed at?

This article is aimed to Python users who know a little about some of the standard machine learning models, but who may not have done much hands-on analysis work. It will also be useful for those who have done some experimentation, but maybe not on a reserving data set.

Pre-requisites to this article

We’ve tried to make this article accessible to people new to ML, and to make this article stand-alone. Having some knowledge about basic machine learning techniques like decision trees, random forests and gradient boosting will help. Furthermore, we also fit the Chain Ladder model as a GLM (sometimes referred to as a Stochastic Chain Ladder) and fit a particular type of LASSO model. We’ve included limited details on these models here. Although our previous blog posts are in R, they have more details on the background of these:

- Reserving with GLMs in R or in Python

- Self-assembling claim reserving models using the LASSO

We also fit some simple neural network models in this Python version.

The data set

Our example deals with using ML to set reserves for a single aggregate 40x40 triangle. We’ve selected the data set because:

- It’s small, so the code will run relatively quickly on your machine - there’s nothing worse than running through a worked example and having to wait hours for results!

- A lot of reserving is still done using traditional accident (or underwriting) + development aggregated triangles so it is relevant to the real world.

We use a simulated data set. There are several reasons for this:

- We know the future results so can examine how different reserve predictions perform.

- We can control how the future experience emerges. In particular, we can ensure there are no future systemic changes (e.g. from legislation or court precedent) that would impact future payments. Changes like this can make it difficult when examining performance of reserve prediction methods on real data - it can be hard to separate poor performance of the model from a good model where the future experience departs markedly from that used to build the model.

- We can share the data set with you.

The data set used is simulated data set 3 from the paper Self-assembling insurance claim models using regularized regression and machine learning. This is a 40x40 triangle of incremental quarterly payments over 10 years. Variables on the data set are accident, development and calendar quarters only. A copy of the data set is available here.

Machine learning and aggregate triangles

Typically, ML and big data go hand-in-hand. By big data we mean lots of observations and lots of features (covariates / independent variables / regressors). Aggregate triangles are small in both senses - small numbers of observations and limited features (often just the 3 time features of accident/underwriting period, development period and calendar period).

This is not to say that it is invalid to use machine learning for aggregate triangles - many people have demonstrated good results from machine learning for such data - there are many papers on this topic. But it’s also true that an experienced actuary using a Chainladder model (or other traditional) method, overlaid with judgement, will often get a similar answer to the best ML method, even for a complex triangle. However ML may be a more efficient way of getting to an answer. In the worked example below, we use a data set which deviates significantly from Chainladder assumptions. Therefore the unadjusted Chainladder projection is quite poor and would need a significant investment of time to yield a better model. In contrast, the better performing ML models we looked at have a better first estimate, so may not require as much intervention to produce a final estimate, thereby leading to a time-saving.

Don’t rank the ML models used based on this example

The purpose of this article is to demonstrate a workflow for fitting ML models in R. While we’ve done some work to improve model fitting, there are a lot more things we would consider if we were looking for the best models (e.g. feature engineering, train/test splits, performance measures). So, although we do look at the relative performance of the different models at the end, you should not make any conclusions about the relative performance of the different ML methods based on this work.

You may find that by adjusting some hyper-parameters, or by revising the training/test data set split, you’re able to find better models. We’ll be discussing this point a bit further at the end of the article.

A priori, given the form of the data (simulated using a regression style structure) and that the LASSO model we used is based on previous work which did aim to establish a framework to fit good models to triangular data using the LASSO, we expected that the LASSO model would perform the best and (spoiler alert!) it did.

The scikit-learn package

One strength of using Python for machine learning is the consistency in input specifications for data. The Python community have generally coalesced onto pandas for data frames, numpy for matrices and scikit-learn for machine learning.

The benefit of these is apparent - set up the data in the aggregator and then switch models in and out at will.

As a rough rule of thumb, when working with scikit-learn we:

- First set up an instance of the class. Note that the class can contain both methods (like functions) and data.

- We then run methods for the class object. These may update the data in the object.

- We can view and use the data in the class object.

If you want to learn more there is plenty of documentation out there:

- The scikit-learn website

- Particularly, this gallery of examples

- Cheatsheets, with explanations

When using Python code, your code editor may also display help and documentation (via “docstrings”). You can also get inline help by using the help() function on an object. This will bring you to help pages.

E.g. import sklearn; help(sklearn) with get you help on sklearn in general.

ML methods used

We’ve looked at the following methods:

- Decision trees

- Random forests

- Gradient boosted machines (GBM) / gradient boosted decision trees

- Neural Networks (a basic one that comes with scikit-learn)

- Chainladder - or rather, a GLM which is set up to replicate the chain ladder estimates (refer to this post for more details)

- LASSO

Outline of the workflow

The workflow we have set up consists of the following:

- Prepare the data for use in the models, including train and test partitions (past data) and hold-out or validation partitions (future data).

- Fit each of the models selected. For each of these we:

- Select hyper-parameters (these control the model-fitting process) for tuning

- Tune the hyper-parameters using the train and test partitions and select the set of values that yield the best results

- Calculate predicted values on the holdout (future) data.

- Run diagnostics on the predicted values for each model and look at the reserve estimates.

We’ll now work through each of the stages below.

Setup

The first step is to import all the packages required for this work (and install them first if needed).

This session uses pandas, numpy, scikit-learn, seaborn, matplotlib and statsmodels.

The versions are shown below. If you are having problems running our code, check that your packages are the same as ours and pip install -U upgrade / downgrade them if needed.

So let us get started with the example with some setup code.

!pip install -U scikit-learnRequirement already satisfied: scikit-learn in /Users/Jacky/opt/miniconda3/lib/python3.9/site-packages (0.24.2)

Requirement already satisfied: threadpoolctl>=2.0.0 in /Users/Jacky/opt/miniconda3/lib/python3.9/site-packages (from scikit-learn) (2.1.0)

Requirement already satisfied: joblib>=0.11 in /Users/Jacky/opt/miniconda3/lib/python3.9/site-packages (from scikit-learn) (1.0.1)

Requirement already satisfied: scipy>=0.19.1 in /Users/Jacky/opt/miniconda3/lib/python3.9/site-packages (from scikit-learn) (1.6.3)

Requirement already satisfied: numpy>=1.13.3 in /Users/Jacky/opt/miniconda3/lib/python3.9/site-packages (from scikit-learn) (1.20.3)

Requirement already satisfied: numpy>=1.13.3 in /Users/Jacky/opt/miniconda3/lib/python3.9/site-packages (from scikit-learn) (1.20.3)!pip show pandas numpy scikit-learn seaborn matplotlibName: pandas

Version: 1.2.4

Summary: Powerful data structures for data analysis, time series, and statistics

Home-page: https://pandas.pydata.org

Author: None

Author-email: None

License: BSD

Location: /Users/Jacky/opt/miniconda3/lib/python3.9/site-packages

Requires: pytz, numpy, python-dateutil

Required-by: seaborn

---

Name: numpy

Version: 1.20.3

Summary: NumPy is the fundamental package for array computing with Python.

Home-page: https://www.numpy.org

Author: Travis E. Oliphant et al.

Author-email: None

License: BSD

Location: /Users/Jacky/opt/miniconda3/lib/python3.9/site-packages

Requires:

Required-by: torchvision, tensorflow, tensorboard, seaborn, scipy, scikit-learn, pandas, opt-einsum, mkl-random, mkl-fft, matplotlib, Keras, Keras-Preprocessing, h5py

---

Name: scikit-learn

Version: 0.24.2

Summary: A set of python modules for machine learning and data mining

Home-page: http://scikit-learn.org

Author: None

Author-email: None

License: new BSD

Location: /Users/Jacky/opt/miniconda3/lib/python3.9/site-packages

Requires: threadpoolctl, scipy, numpy, joblib

Required-by:

---

Name: seaborn

Version: 0.11.1

Summary: seaborn: statistical data visualization

Home-page: https://seaborn.pydata.org

Author: Michael Waskom

Author-email: mwaskom@nyu.edu

License: BSD (3-clause)

Location: /Users/Jacky/opt/miniconda3/lib/python3.9/site-packages

Requires: scipy, pandas, matplotlib, numpy

Required-by:

---

Name: matplotlib

Version: 3.4.2

Summary: Python plotting package

Home-page: https://matplotlib.org

Author: John D. Hunter, Michael Droettboom

Author-email: matplotlib-users@python.org

License: PSF

Location: /Users/Jacky/opt/miniconda3/lib/python3.9/site-packages

Requires: python-dateutil, kiwisolver, numpy, pillow, cycler, pyparsing

Required-by: seaborn

import pandas as pd

import numpy as np

from sklearn.linear_model import PoissonRegressor

from sklearn.experimental import enable_hist_gradient_boosting

from sklearn.tree import DecisionTreeRegressor, plot_tree

from sklearn.ensemble import RandomForestRegressor, GradientBoostingRegressor

from sklearn.ensemble import HistGradientBoostingRegressor

from sklearn.neural_network import MLPRegressor

from sklearn.compose import TransformedTargetRegressor

from sklearn.compose import ColumnTransformer

from sklearn.preprocessing import OneHotEncoder, StandardScaler, MinMaxScaler

from sklearn.pipeline import Pipeline

from sklearn.model_selection import GridSearchCV, RandomizedSearchCV

from sklearn.metrics import mean_squared_error

from sklearn.utils import all_estimators

import seaborn as sns

import matplotlib.pyplot as plt

from matplotlib.colors import LogNorm

import time

import itertools

# Set the seed for the random number generation so

# results are reproducible.

import random

random.seed(0)

np.random.seed(0)

# colours for plots - not all are used

# We will also use viridis for some plots

plot_colors = {

"dblue" : "#113458",

"mblue" : "#4096b8",

"gold" : "#d9ab16",

"lgrey" : "#dcddd9",

"dgrey" : "#3f4548",

"black" : "#3F4548",

"red" : "#d01e45",

"purple" : "#8f4693",

"orange" : "#ee741d",

"fuscia" : "#e9458c",

"violet" : "#8076cf"

}Data preparation

We’re using a simulated data triangle with all values (past and future).

The data set we use is the simulated data set 3 from this paper. It is available in CSV form here.

This is a 40x40 triangle of payments:

- That vary by accident quarter

- That vary by development quarter

- Have varying rates of superimposed inflation in payment size by calendar quarter (including no inflation)

- Have a step-up in payment size for accident quarters > 16 and development quarters > 20.

The first two effects are captured by a Chainladder model but the last two effects depart from Chainladder assumptions.

The pandas package

We’ll be using the pandas package for manipulating the data. There’s an introduction to pandas on its website if you are unfamiliar with it.

Load the data

First, load in the data and have a look at it.

# 1-4 will bring up different datasets. Covered in "next steps" note at the end of the article

dataset_number = 3

dat = pd.read_csv(

f"https://institute-and-faculty-of-actuaries.github.io/mlr-blog/documents/csv/lasso_simdata{dataset_number}.csv",

dtype={

"pmts": np.float32,

"acc": np.float32,

"dev": np.float32,

"cal": np.float32,

"mu": np.float32,

"train_ind": bool

})

dat.head()

# create the num_periods variable - number of acc/dev periods

num_periods = int(dat["acc"].max())As you can see, the data is not in triangular form as per the diagram above, but is instead in long form where:

- each row of the data set consists of one observation

- each observation has the accident(

acc), development(dev) and calendar(cal) period associated with it - the

muvalue is the mean value of the distribution from whichpmtswas simulated - this won’t form part of the analysis below so can be ignored - the final variable,

train_indisTRUEfor past values andFALSEfor future values.

This long format of data is standard for a lot of modelling and data analysis.

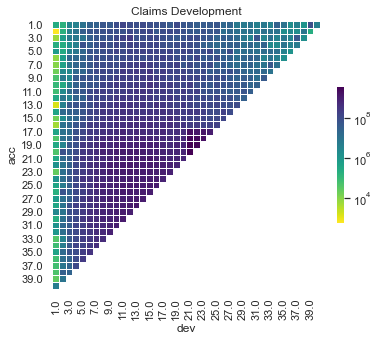

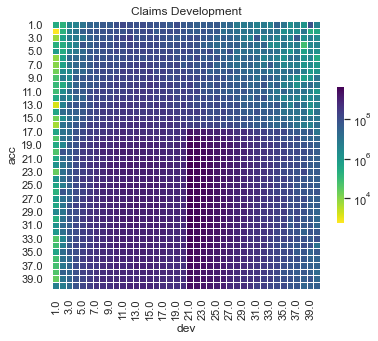

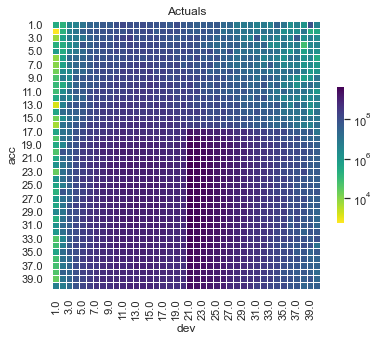

We can also show a visualisation of the data. This contains both past and future data (with a diagonal line marking the boundary). The plot uses shading to indicate the size of the payments (specifically, log(payments)). The step-up in claim size (acc > 16 and dev > 20) is quite obvious in this graphic. What is also apparent is this this increase only affects a small part of the past triangle (10 cells out of 820 to be exact), but impacts much of the future lower triangle.

def plot_triangle(

data,

mask_bottom=True,

title="Claims Development",

cmap=sns.color_palette("viridis_r", as_cmap=True), # Use Viridis colour palette just like the R code

center=None,

fig=None,

ax=None):

""" Plots a claims triangle heatmap

data:

Pandas DataFrame, indexed by date

mask_bottom:

Hide bottom half of triangle. Assumes origin and development periods

are the same. e.g. both months

cmap:

Seaborn colour palette

center:

Centre for heatmap

fig, ax: optional fig and ax

"""

sns.set(style="white")

# Generate a mask for the triangle

if mask_bottom:

mask = np.ones_like(data, dtype=bool)

mask[np.tril_indices_from(mask)] = False

mask = np.flipud(mask)

else:

mask = None

# Set up the matplotlib figure

if fig is None or ax is None:

fig, ax = plt.subplots(figsize=(6, 5))

# Draw the heatmap with the mask and correct aspect ratio vmax=.3,

sns.heatmap(

data,

mask=mask,

cmap=cmap,

square=True,

linewidths=0.5,

fmt=".0f",

cbar_kws={"shrink": 0.5},

norm=LogNorm() # Log scale

).set_title(title)

return fig, ax

# Partial triangle - the model only sees this for training

plot_triangle(

dat.pivot(index="acc", columns="dev", values="pmts"),

mask_bottom=True

)

plt.show()

# Whole triangle - with test dataset

plot_triangle(

dat.pivot(index="acc", columns="dev", values="pmts"),

mask_bottom=False

)

plt.show()

The step-up in payments can be modelled as an interaction between accident and development quarters. Because it affects only a small number of past values, it may be difficult for some of the modelling approaches to capture this. It’s likely, therefore, that the main differentiator between the performance of different methods for this data set will be how much well they capture this interaction.

One thing to note is that the Chainladder will struggle with this data set. Both the calendar period terms and the interaction are not effects that the Chainladder can model - it assumes that only accident and development period main effects (i.e. no interactions) are present. So an actuary using the Chainladder for this data set would need to overlay judgement to obtain a good result.

We need to modify this data a little before proceeding further and add factor versions (essentially a categorical version) of acc and dev - these are needed later for fitting the Chainladder.

# Factors with zero index

dat["accf"] = (dat.acc - 1).astype(int)

dat["devf"] = (dat.dev - 1).astype(int)Train and Test

X_train = (dat.loc[dat.train_ind, ["acc", "dev", "cal", "accf", "devf"]])

y_train = (dat.loc[dat.train_ind, "pmts"])

X_test = (dat.loc[dat.train_ind == False, ["acc", "dev", "cal", "accf", "devf"]])

y_test = (dat.loc[dat.train_ind == False, "pmts"])

X = (dat.loc[:, ["acc", "dev", "cal", "accf", "devf"]])

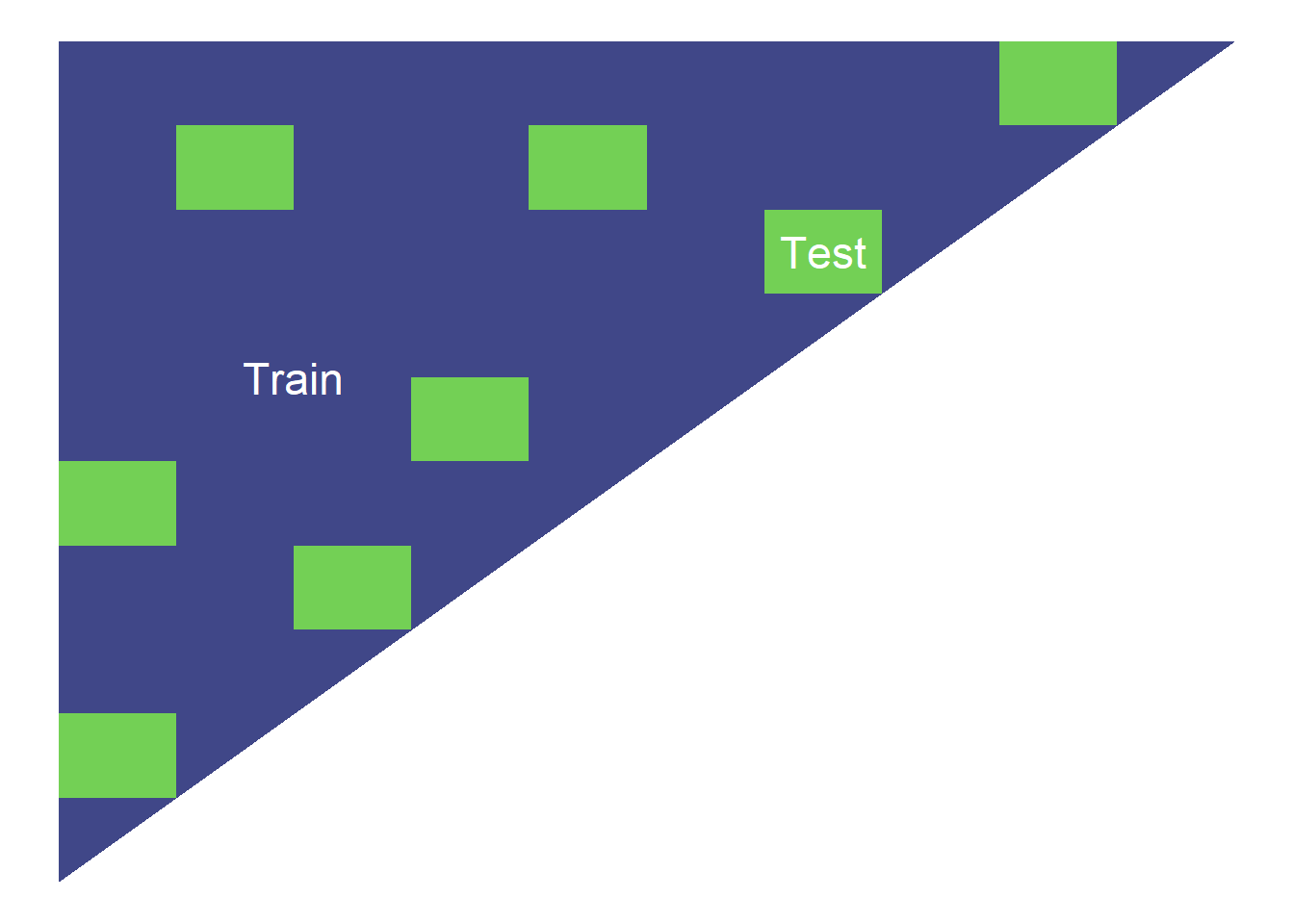

y = (dat.loc[:, "pmts"])Tuning process for hyper-parameters

Machine learning models have a number of hyper-parameters that control the model fit. Tweaking the hyper-parameters that control model fitting (e.g. for decision trees, the depth of the tree, or for random forests, the number of trees to average over) can have a significant impact on the quality of the fit. The standard way of doing this is to use a train and test data set where:

- The model is trained (built) on the train data set

- The performance of the model is evaluated on the test data set

- This is repeated for a number of different combinations of hyper-parameters, and the best performing one is selected.

Evaluating the models on a separate data set not used in the model fitting helps to control over-fitting. Usually we would then select the hyper-parameters that lead to the best results on the test data set and use these to predict our future values.

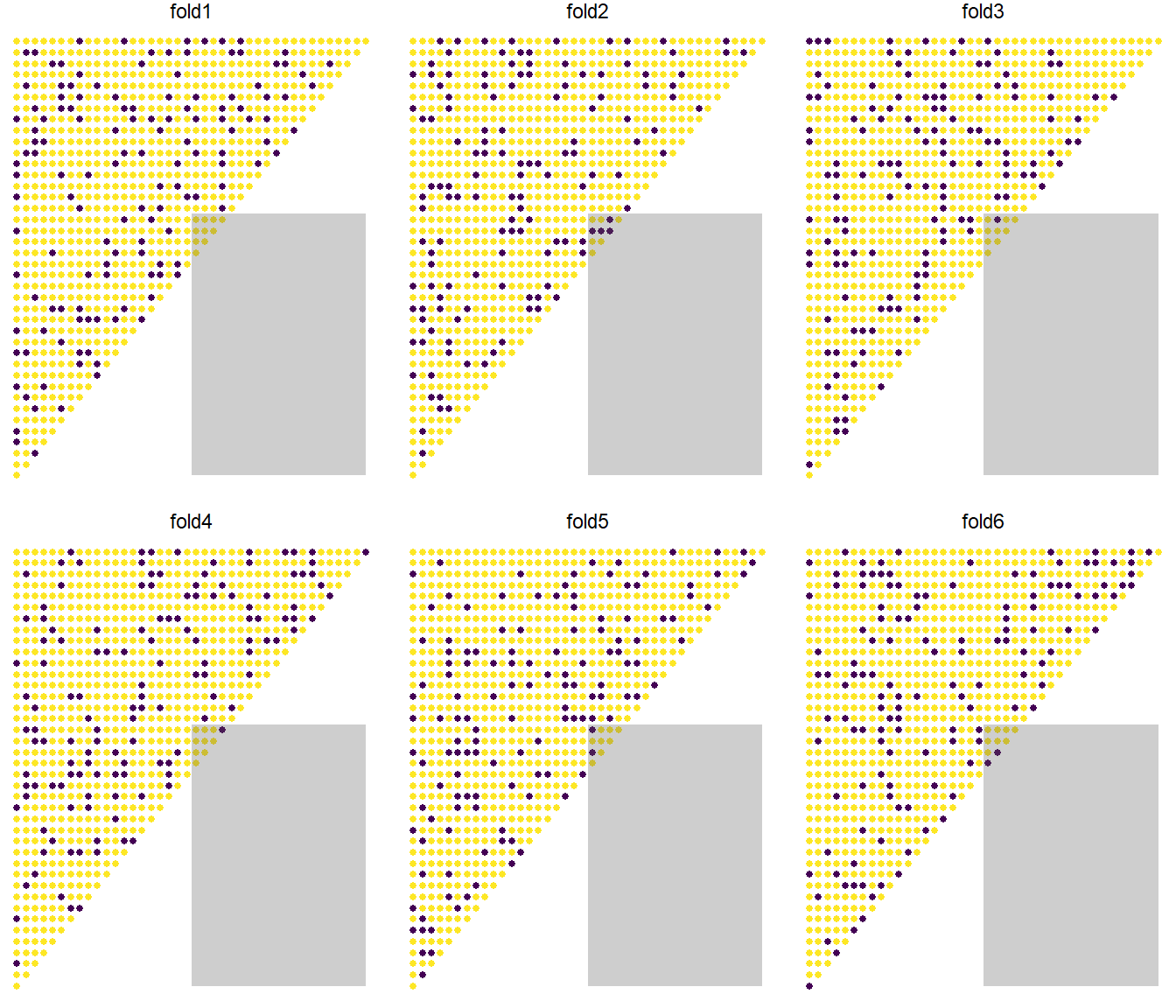

There are various ways we can select the test and train data sets. For this work we use cross-validation. We’ll give a brief overview of it below. Note that we will be discussing validation options in a separate article.

Cross-validation

The simplest implementation of a train and test partition is a random one where each point in the data set is allocated to train and test at random. Typically, the train part might be around 70-80% of the data and the test part the remainder.

Random test data set

Cross-validation repeats this type of split a number of times.

In more detail, the steps are:

- Randomly partition the data into k equal-sized folds (between 5-10 folds are common choices). These folds are then fixed for the remainder of the algorithm.

- Fit the model using data from k-1 of the folds, using the remaining fold as the test data. Do this k times, so each fold is used as test data once.

- Calculate the performance metrics for each model on the corresponding test fold.

- Average the performance metrics across all the folds.

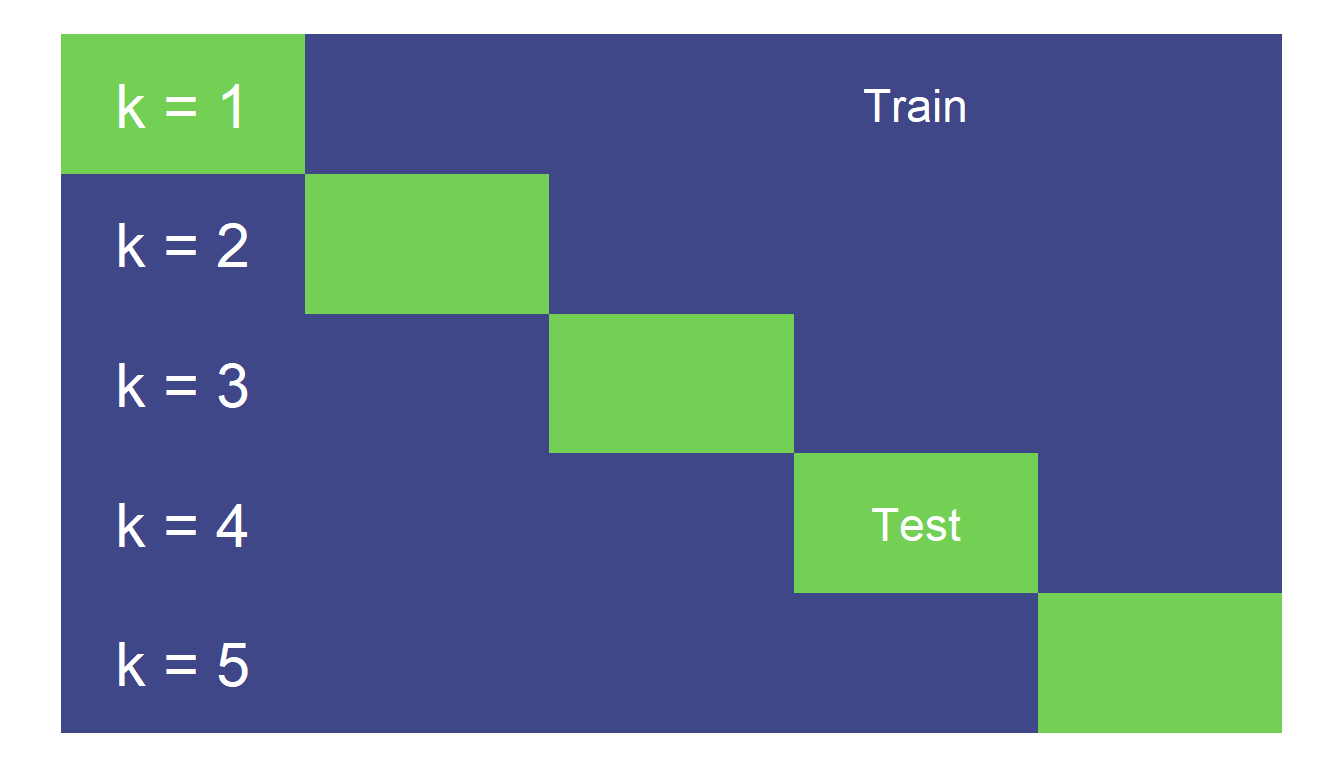

A simplified representation of the process is given below.

5-fold cross validation

Cross-validation provides an estimate of out-of-sample performance even though all the data is used for training and testing. It is often considered more robust due to its use of the full dataset for testing, but can be computationally expensive for larger datasets. Here we only have a small amount of data, so there is an advantage to using the full dataset, whilst the computational cost is manageable.

Cross-validation in scikit-learn

We will be setting up cross-validation resamplers in scikit-learn to apply to our models and find optimal hyper-parameters. As always, the documentation for cross validation, grid search CV and random search CV are useful starting reference point.

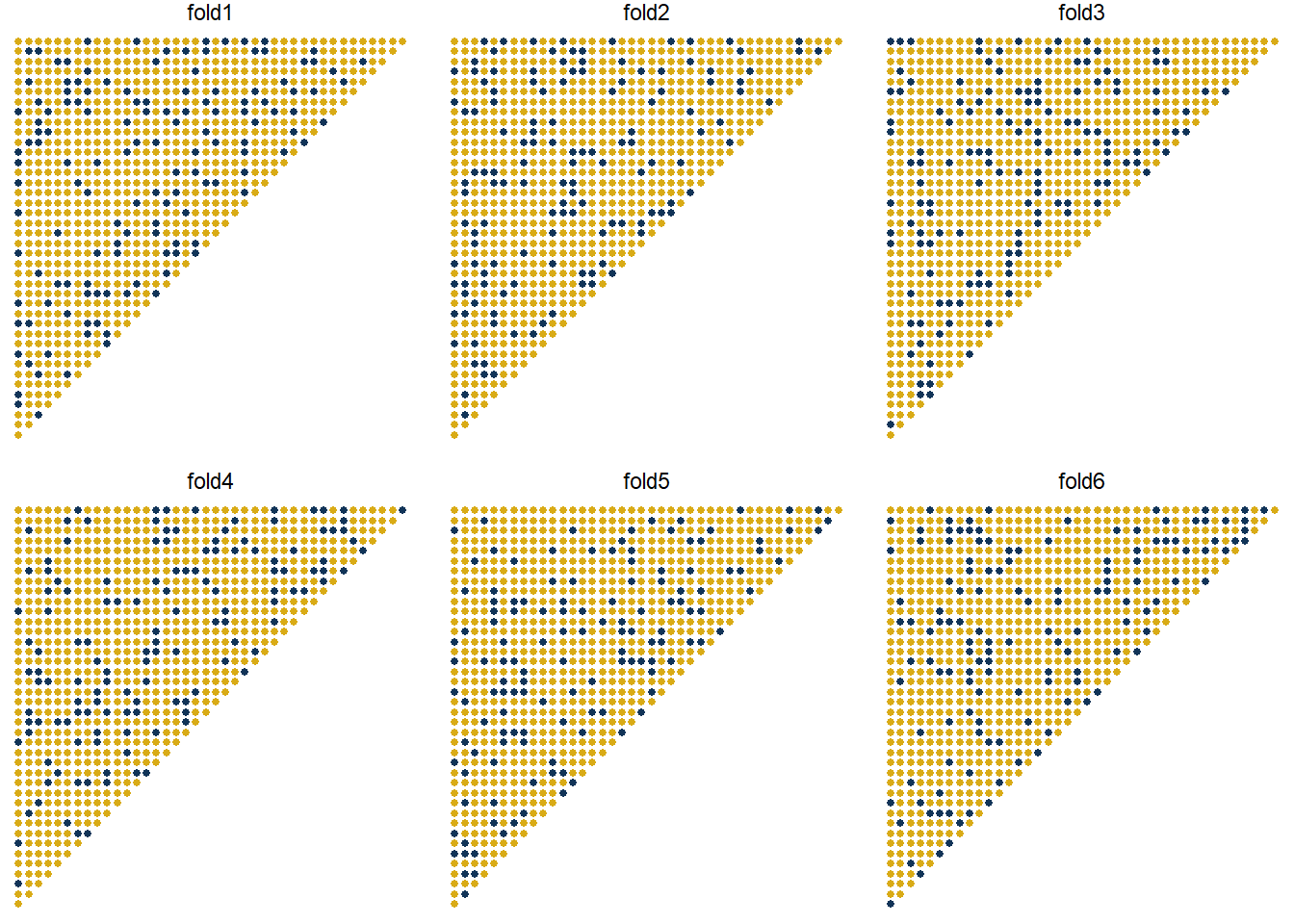

Here we will use 6-fold cross validation. As applied to our triangles, it will look something like this, where the yellow points are the training data and the blue the test data in each fold:

Performance measure

During the cross-validation process, we need to have a performance measure to optimise.

Here we will use RMSE (root mean square error).

Searching hyper-parameter space

Searching hyper-parameter space needs to be customised to each model, so we can’t set up a common framework here. However, to control computations, it is useful to set a limit on the number of searches that can be performed in a tuning exercise.

Given how we set up the tuning process below we need 25 evaluations for the decision tree and random forest models. We need many more evaluations for the GBM model since we tune more parameters. However, this can take a long time to run. In practice, using a more powerful computer, or running things in parallel can help.

So we’ve set the number of evaluations to a low number here (25).

Fitting some ML models

Now it’s time to fit and tune the following ML models using scikit-learn:

- Decision tree

- Random forest

- Gradient boosting machines (GBM)

- Neural Network

Decision tree

A decision tree is unlikely to be a very good model for this data, and tuning often doesn’t help much. Nonetheless, it’s a simple model, so it’s useful to fit it to see what happens.

To illustrate the use of scikit-learn, we’ll first show how to fit a model using the default hyper-parameters. We’ll then move onto the code needed to run hyper-parameter tuning using cross-validation.

Fitting a single model

First let’s fit a simple decision tree.

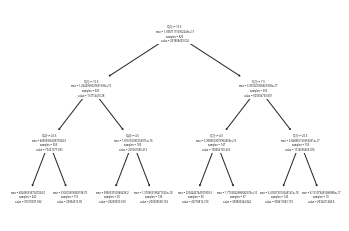

dtree = DecisionTreeRegressor(max_depth=3)

dtree.fit(X_train, y_train)

plot_tree(dtree)

plt.show()

Unfortunately this plot is too small to read. If you are unfamiliar with decision tree diagrams, then these diagrams give splitting rules for the data. At the terminal nodes, predicted values for each segment are given. If you are able to read this plot (e.g. you are running the Jupyter notebook), then

Here’s a list of the parameters - the documentation will have more information.

dtree.get_params(){'ccp_alpha': 0.0,

'criterion': 'mse',

'max_depth': 3,

'max_features': None,

'max_leaf_nodes': None,

'min_impurity_decrease': 0.0,

'min_impurity_split': None,

'min_samples_leaf': 1,

'min_samples_split': 2,

'min_weight_fraction_leaf': 0.0,

'random_state': None,

'splitter': 'best'}Let’s try tuning the max_depth and ‘ccp_alpha’ parameters.

Tuning the decision tree

To set up the tuning we need to specify:

- The ranges of values to search over

- A resampling strategy (already have this - crossvalidation)

- An evaluation measure (this is RMSE)

- A termination criterion so searches don’t go on for ever (our

evals_trm) - The search strategy (e.g. grid search, random search, etc - see, e.g., this post )

We first set ranges of values to consider for these: * criterion: whether to fit on the basis of mse which aligns with our evaluation metric or poisson to match the log-link GLMs later in the piece * max_depth: how big the trees can be, * ccp_alpha: complexity parameter for pruning.

parameters_tree = {

"criterion": ["mse", "poisson"],

"max_depth": [2, 3, 5, 7, None], # None is unlimited depth.

"ccp_alpha": [0.0, 0.2, 0.4, 0.6, 0.8]

}5 of each of max_depth and ccp_alpha for a 2x5x5 grid. Given we only have 50 points, we can easily evaluate every option so we’ll use a grid search strategy.

In practice other search strategies may be preferable - e.g. a random search often gets similar results to a grid search, in a much smaller amount of time. Another possible choice is Bayesian optimisation search.

So now we have everything we need to tune our hyper-parameters so we can set this up with GridSearchCV now.

grid_tree = GridSearchCV(DecisionTreeRegressor(), parameters_tree)

grid_tree.fit(X_train, y_train)GridSearchCV(estimator=DecisionTreeRegressor(), param_grid={‘ccp_alpha’: [0.0, 0.2, 0.4, 0.6, 0.8], ‘criterion’: [‘mse’, ‘poisson’], ‘max_depth’: [2, 3, 5, 7, None]})

The parameters in the best fit may be accessed here:

grid_tree.best_estimator_.get_params(){‘ccp_alpha’: 0.8, ‘criterion’: ‘mse’, ‘max_depth’: None, ‘max_features’: None, ‘max_leaf_nodes’: None, ‘min_impurity_decrease’: 0.0, ‘min_impurity_split’: None, ‘min_samples_leaf’: 1, ‘min_samples_split’: 2, ‘min_weight_fraction_leaf’: 0.0, ‘random_state’: None, ‘splitter’: ‘best’}

These also fit a final model to the data using these optimised parameters.

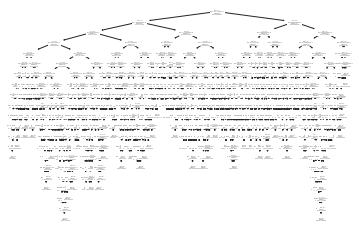

# plot the model

plot_tree(grid_tree.best_estimator_)

plt.show()

This model is much more complicated than the original and looks overfitted - we’ll see if this is the case when we evaluate the model performance later in the article.

Random forest fitting

The random forest model for regression is sklearn.ensemble.RandomForestRegressor.

Let’s have a look at the hyper-parameters.

rforest = RandomForestRegressor()

rforest.fit(X_train, y_train)

rforest.get_params(){‘bootstrap’: True, ‘ccp_alpha’: 0.0, ‘criterion’: ‘mse’, ‘max_depth’: None, ‘max_features’: ‘auto’, ‘max_leaf_nodes’: None, ‘max_samples’: None, ‘min_impurity_decrease’: 0.0, ‘min_impurity_split’: None, ‘min_samples_leaf’: 1, ‘min_samples_split’: 2, ‘min_weight_fraction_leaf’: 0.0, ‘n_estimators’: 100, ‘n_jobs’: None, ‘oob_score’: False, ‘random_state’: None, ‘verbose’: 0, ‘warm_start’: False}

Here, we’ll try tuning max_depth and ‘ccp_alpha’ parameters again.

We’ll follow the same steps as for decision trees - set up a parameter space for searching, combine this with RMSE and cross-validation, tune using grid search, and get the best fit.

parameters_forest = {

"max_depth": [2, 3, 5, 7, None], # None is unlimited depth.

"ccp_alpha": [0.0, 0.2, 0.4, 0.6, 0.8],

"random_state": [0]

}

grid_forest = GridSearchCV(

RandomForestRegressor(),

parameters_forest,

n_jobs=-1)

grid_forest.fit(X_train, y_train)

grid_forest.best_estimator_.get_params(){‘bootstrap’: True, ‘ccp_alpha’: 0.0, ‘criterion’: ‘mse’, ‘max_depth’: None, ‘max_features’: ‘auto’, ‘max_leaf_nodes’: None, ‘max_samples’: None, ‘min_impurity_decrease’: 0.0, ‘min_impurity_split’: None, ‘min_samples_leaf’: 1, ‘min_samples_split’: 2, ‘min_weight_fraction_leaf’: 0.0, ‘n_estimators’: 100, ‘n_jobs’: None, ‘oob_score’: False, ‘random_state’: 0, ‘verbose’: 0, ‘warm_start’: False}

GBM

There are two GBM implementations in scikit-learn. The first is sklearn.ensemble.GradientBoostingRegressor which implements a “traditional” GBM.

The other is sklearn.ensemble.HistGradientBoostingRegressor which implements a number of performance tricks to speed up model fitting, similar to LightGBM or the fast histogram method in XGBoost. This is considered an experimental feature with the scikit-learn version we are using.

Here are the GBM parameters.

gbm = GradientBoostingRegressor()

gbm.fit(X_train, y_train)

gbm.get_params(){‘alpha’: 0.9, ‘ccp_alpha’: 0.0, ‘criterion’: ‘friedman_mse’, ‘init’: None, ‘learning_rate’: 0.1, ‘loss’: ‘ls’, ‘max_depth’: 3, ‘max_features’: None, ‘max_leaf_nodes’: None, ‘min_impurity_decrease’: 0.0, ‘min_impurity_split’: None, ‘min_samples_leaf’: 1, ‘min_samples_split’: 2, ‘min_weight_fraction_leaf’: 0.0, ‘n_estimators’: 100, ‘n_iter_no_change’: None, ‘random_state’: None, ‘subsample’: 1.0, ‘tol’: 0.0001, ‘validation_fraction’: 0.1, ‘verbose’: 0, ‘warm_start’: False}

With gradient boosting, it is often helpful to optimise over hyper-parameters, so we will vary some parameters and select the best performing set.

For speed reasons we will just consider n_estimators, learning_rate, max_depth , and subsample but in practice, we could consider doing more.

The steps are the generally same as before for decision trees and random forests. However as we are searching over a greater number of parameters, we’ve switched to a random search to try to achieve better results.

Depending on your computer, this step takes a while to run since we are running the slower GradientBoostingRegressor - even though we have a low n_iter - so it might be a good point to grab a cup of coffee or tea!

parameters_gbm = {

"n_estimators": [100, 200, 300, 400, 500],

"max_depth": [1, 2, 3, 5, 6],

"learning_rate": [0.01, 0.02, 0.05, 0.1, 0.3],

"subsample": [0.5, 0.7, 1.0]

}

tic = time.perf_counter()

grid_gbm = RandomizedSearchCV(

GradientBoostingRegressor(),

parameters_gbm,

n_iter=25,

n_jobs=-1, # Run in parallel

random_state=0

)

grid_gbm.fit(X_train, y_train)

toc = time.perf_counter()

print(f"Ran in {toc - tic:0.4f} seconds")Ran in 7.4581 seconds

# Get the best fit:

grid_gbm.best_estimator_.get_params(){'alpha': 0.9,

'ccp_alpha': 0.0,

'criterion': 'friedman_mse',

'init': None,

'learning_rate': 0.01,

'loss': 'ls',

'max_depth': 5,

'max_features': None,

'max_leaf_nodes': None,

'min_impurity_decrease': 0.0,

'min_impurity_split': None,

'min_samples_leaf': 1,

'min_samples_split': 2,

'min_weight_fraction_leaf': 0.0,

'n_estimators': 400,

'n_iter_no_change': None,

'random_state': None,

'subsample': 0.5,

'tol': 0.0001,

'validation_fraction': 0.1,

'verbose': 0,

'warm_start': False}However, remember that these results are from 25 evaluations only, and with 4 hyper-parameters, we’d really like to use more evaluations. The model above isn’t a particularly good one.

Next, the HistGradientBooster which is most similar to LightGBM, which was in turn based on XGBoost. It’s quite possible to install those packages too to include more full featured models but to make this tutorial code easy to install and use, we won’t introduce the extra dependencies and just use the scikit-learn implementation:

parameters_hgbm = {

"loss": ["least_squares", "poisson"],

"max_iter": [100, 200, 300, 400, 500],

"max_depth": [1, 2, 3, 5, 6],

"learning_rate": [0.01, 0.02, 0.05, 0.1, 0.3]

}

tic = time.perf_counter()

# This regressor is generally quite fast so we can run a few more.

grid_hgbm = RandomizedSearchCV(

HistGradientBoostingRegressor(),

parameters_hgbm,

n_iter=100,

n_jobs=-1, # Run in parallel

random_state=0

)

grid_hgbm.fit(X_train, y_train)

toc = time.perf_counter()

print(f"Ran in {toc - tic:0.4f} seconds")

# It was not faster in this case with this dataset.Ran in 38.4765 seconds

# Get the best fit:

grid_hgbm.best_estimator_.get_params(){'categorical_features': None,

'early_stopping': 'auto',

'l2_regularization': 0.0,

'learning_rate': 0.1,

'loss': 'poisson',

'max_bins': 255,

'max_depth': 6,

'max_iter': 400,

'max_leaf_nodes': 31,

'min_samples_leaf': 20,

'monotonic_cst': None,

'n_iter_no_change': 10,

'random_state': None,

'scoring': 'loss',

'tol': 1e-07,

'validation_fraction': 0.1,

'verbose': 0,

'warm_start': False}In the R code, we mentioned a previously tuned XGBoost model with hyperparameters tuned over a larger search. Can we replicate the model in Python here?

gbm_prev = HistGradientBoostingRegressor(

loss='poisson', # Poisson is close to Tweedie with variance power 1.01

max_iter=233,

learning_rate=0.3,

max_depth=3

)

gbm_prev.fit(X_train, y_train)HistGradientBoostingRegressor(learning_rate=0.3, loss='poisson', max_depth=3,

max_iter=233)Neural Network

Neural networks - also known as deep learning models - are models based on interconnected neurons which take in inputs, apply a function and produce outputs used by other neurons, ultimately to predict response variables.

In the R article with mlr3 we skipped neural networks as these required keras which can be a little tricky to install. However, scikit-learn includes a simple Multi-layer Perceptron model so we will try that here.

This is a simple feedforward model where each layer is connected in order.

Unlike the diagram all neurons are just simply connected to all neurons in the following layer. But there are many variations on how those neurons can be connected which we may explore in future articles.

With the features, we will transform accident, development and calendar periods with one-hot encoding to treat them as continuous variables, and let the model figure the rest out. With the target, given the average value is approx $300m, we’ll scale it so the model can hopefully find convergence faster - and we will try a few different learning rates.

parameters_nn = {

"hidden_layer_sizes": [

# Keep these to 50 neurons to keep things small

# (We do only have 3 factors)

(50,), # single hidden layer

(25, 25), # two layers

(16, 16, 16), # three layers

(12, 12, 12, 12), # four layers

(30, 15, 5), # bottleneck model - reduce data to 10 final effects

],

"alpha": [0.00001, 0.0001, 0.001, 0.01, 0.1],

# Activation: Relu is standard but logistic / sigmoid has been used by some

# researchers in reserving applications

"activation": ["logistic", "relu"],

"random_state": [0],

"max_iter": [200000] # More iterations worked well for lasso model in R

}

col_transformer_nn = ColumnTransformer(

[

('zero_to_one', MinMaxScaler(), ["acc", "dev", "cal"])

],

remainder='drop'

)

tic = time.perf_counter()

neural_network = Pipeline(

steps=[

('transform', col_transformer_nn),

('nn', TransformedTargetRegressor(

regressor=RandomizedSearchCV(

MLPRegressor(),

parameters_nn,

n_jobs=-1, # Run in parallel

n_iter=25, # Models train slowly, so try only a few models

random_state=0),

# An output activation function of exp would have been nice

# But not available in scikit, so we will fit on log-transformed

# values and exponentiate.

func=lambda x: np.log(x / y_train.mean()),

inverse_func=lambda x: np.exp(x) * y_train.mean(),

check_inverse=False))

]

)

neural_network.fit(X_train, y_train)

toc = time.perf_counter()

print(f"Ran in {toc - tic:0.4f} seconds")Ran in 86.3401 seconds

neural_network["nn"].regressor_.best_estimator_.get_params(){‘activation’: ‘relu’, ‘alpha’: 1e-05, ‘batch_size’: ‘auto’, ‘beta_1’: 0.9, ‘beta_2’: 0.999, ‘early_stopping’: False, ‘epsilon’: 1e-08, ‘hidden_layer_sizes’: (12, 12, 12, 12), ‘learning_rate’: ‘constant’, ‘learning_rate_init’: 0.001, ‘max_fun’: 15000, ‘max_iter’: 200000, ‘momentum’: 0.9, ‘n_iter_no_change’: 10, ‘nesterovs_momentum’: True, ‘power_t’: 0.5, ‘random_state’: 0, ‘shuffle’: True, ‘solver’: ‘adam’, ‘tol’: 0.0001, ‘validation_fraction’: 0.1, ‘verbose’: False, ‘warm_start’: False}

Before we do any analysis, let’s fit a couple more models to compare these results against:

- a Chainladder model

- a LASSO model

Chainladder - the baseline model

Since this is a traditional triangle, it seems natural to compare any results to the Chainladder result. So here, we will get the predicted values and reserve estimate for the Chainladder model.

It’s important to note that we will just use a volume-all Chainladder (i.e. include all periods in the estimation of the development factors) and will not attempt to impose any judgement over the results. In practice, of course, models like the Chainladder are often subject to additional analysis, reasonableness tests and manual assumption selections, so it’s likely the actual result would be different, perhaps significantly, from that returned here.

At the same time, no model, whether it be the Chainladder, or a more sophisticated ML model should be accepted without further testing, so on that basis, comparing Chainladder and ML results without modification is a reasonable thing to do. Better methods should require less human intervention to return a reasonable result.

Getting the Chainladder reserve estimates

The Chainladder reserve can also be calculated using a GLM with:

- Accident and development factors

- The Poisson or over-dispersed Poisson distribution

- The log link.

We’ve used this method here as it’s easy to set up in Python but practical work using the Chainladder may be better done with a package like the Python Chainladder package by CASact.

The easiest way to do this is to use Pipelines which allows us to have a neat package of a model that comes with its own data transformations - specifically to use accf and devf properly.

Here’s the code using PoissonRegressor and the predict() method to add predicted values into model_forecasts.

col_transformer = ColumnTransformer(

[('encoder', OneHotEncoder(), ["accf", "devf"])],

remainder='drop'

)

# PoissonRegressor gives a log-link GLM. But need to set alpha=0 so it is not a LASSO.

chain_ladder = Pipeline(

steps=[

('transform', col_transformer),

('glm', PoissonRegressor(alpha=0, max_iter=5000))

]

)

chain_ladder.fit(X_train, y_train)Pipeline(steps=[(‘transform’, ColumnTransformer(transformers=[(‘encoder’, OneHotEncoder(), [‘accf’, ‘devf’])])), (‘glm’, PoissonRegressor(alpha=0, max_iter=5000))])

LASSO (regularised regression)

Finally, we will use the LASSO to fit a model. We are going to fit the same model as we did in our previous post. We’ll include a bare-bones description of the model here. If you haven’t seen it before, then you may want to just take the model as given and skip ahead to the next section. Once you’ve read this entire article you may then wish to read the post on the LASSO model to understand the specifics of this model.

The main things to note about this model are:

- Feature engineering is needed to produce continuous functions of accident / development / calendar quarters for the LASSO to fit.

- The blog post and related paper detail how to do this - essentially we create a large group of basis functions from the primary

acc,devandcalvariables that are flexible enough to capture a wide variety of shapes. - We need to create a model that contains these basis functions as features.

- We then need to fit and predict using the values for a particular penalty setting (the regularisation parameter) - following the paper, we use the penalty value that leads to the lowest cross-validation error.

Basis functions

The first step is to create all the basis functions that we need. The functions below create the ramp and step functions needed (over 4000 of these!). The end result is a data.table of the original payments and all the basis functions. As noted above, all the details are in the blog post and paper.

def LinearSpline(var, start, stop):

"""

Linear spline function - used in data generation and in spline generation below

"""

return np.minimum(stop - start, np.maximum(0, var - start))

def GetScaling(vec):

"""

Function to calculate scaling factors for the basis functions

scaling is discussed in the paper

"""

fn = len(vec)

fm = np.mean(vec)

fc = vec - fm

return ((np.sum(fc**2))/fn)**0.5

def GetRamps(vec, vecname, nperiods, scaling):

"""

Function to create the ramps for a particular primary vector

vec = fundamental regressor

vecname = name of regressor

np = number of periods

scaling = scaling factor to use

"""

df = pd.DataFrame.from_dict(

{

f"L_{i}_999_{vecname}": LinearSpline(vec, i, 999) / scaling

for i in range(1, nperiods)

}

)

return df

def GetInts(vec1, vec2, vecname1, vecname2, nperiods, scaling1, scaling2, train_ind):

"""

Create the step (heaviside) function interactions.

f"I_{vecname1}_ge_{i}xI_{vecname2}_ge_{j}" formats the name of the column

LinearSpline(vec1, 1, i+1) / scaling1 * LinearSpline(vec2, j, j + 1) / scaling2

is the interaction term

and we loop over all combinations of 1:nperiods and 2:nperiods

"""

vecs = {}

for i, j in itertools.product(*[range(2, nperiods), range(2, nperiods)]):

interaction = (

LinearSpline(vec1, i - 1, i) / scaling1 *

LinearSpline(vec2, j - 1, j) / scaling2

)

# Only include if non-constant over training data

if not np.all(interaction[train_ind] == interaction[0]):

vecs[f"I_{vecname1}_ge_{i}xI_{vecname2}_ge_{j}"] = interaction

df = pd.DataFrame.from_dict(vecs)

return dfNow the functions are defined, we’ll create a data.table of basis functions here which we’ll use later when fitting the LASSO. The dat_plus table will hold them.

# get the scaling values

rho_factor_list = {

v: GetScaling(dat.loc[dat.train_ind, v].values)

for v in ["acc", "dev", "cal"]

}

rho_factor_list{'acc': 9.539392014169456, 'dev': 9.539392014169456, 'cal': 9.539392014169456}

# main effects - matrix of values

main_effects_acc = GetRamps(vec = dat["acc"], vecname = "acc", nperiods = num_periods, scaling = rho_factor_list["acc"])

main_effects_dev = GetRamps(vec = dat["dev"], vecname = "dev", nperiods = num_periods, scaling = rho_factor_list["dev"])

main_effects_cal = GetRamps(vec = dat["cal"], vecname = "cal", nperiods = num_periods, scaling = rho_factor_list["cal"])

main_effects = pd.concat([main_effects_acc, main_effects_dev, main_effects_cal], axis="columns")main_effects looks like this:

main_effects| L_1_999_acc | L_2_999_acc | L_3_999_acc | L_4_999_acc | L_5_999_acc | L_6_999_acc | L_7_999_acc | L_8_999_acc | L_9_999_acc | L_10_999_acc | ... | L_30_999_cal | L_31_999_cal | L_32_999_cal | L_33_999_cal | L_34_999_cal | L_35_999_cal | L_36_999_cal | L_37_999_cal | L_38_999_cal | L_39_999_cal | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.00000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 1 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.00000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 2 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.00000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 3 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.00000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 4 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.00000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 1595 | 4.088311 | 3.983482 | 3.878654 | 3.773825 | 3.668997 | 3.564168 | 3.45934 | 3.354511 | 3.249683 | 3.144854 | ... | 4.717281 | 4.612453 | 4.507625 | 4.402796 | 4.297967 | 4.193139 | 4.088311 | 3.983482 | 3.878654 | 3.773825 |

| 1596 | 4.088311 | 3.983482 | 3.878654 | 3.773825 | 3.668997 | 3.564168 | 3.45934 | 3.354511 | 3.249683 | 3.144854 | ... | 4.822110 | 4.717281 | 4.612453 | 4.507625 | 4.402796 | 4.297967 | 4.193139 | 4.088311 | 3.983482 | 3.878654 |

| 1597 | 4.088311 | 3.983482 | 3.878654 | 3.773825 | 3.668997 | 3.564168 | 3.45934 | 3.354511 | 3.249683 | 3.144854 | ... | 4.926939 | 4.822110 | 4.717281 | 4.612453 | 4.507625 | 4.402796 | 4.297967 | 4.193139 | 4.088311 | 3.983482 |

| 1598 | 4.088311 | 3.983482 | 3.878654 | 3.773825 | 3.668997 | 3.564168 | 3.45934 | 3.354511 | 3.249683 | 3.144854 | ... | 5.031767 | 4.926939 | 4.822110 | 4.717281 | 4.612453 | 4.507625 | 4.402796 | 4.297967 | 4.193139 | 4.088311 |

| 1599 | 4.088311 | 3.983482 | 3.878654 | 3.773825 | 3.668997 | 3.564168 | 3.45934 | 3.354511 | 3.249683 | 3.144854 | ... | 5.136595 | 5.031767 | 4.926939 | 4.822110 | 4.717281 | 4.612453 | 4.507625 | 4.402796 | 4.297967 | 4.193139 |

1600 rows × 117 columns

# Export to file for debugging

# main_effects.to_csv("main_effects_py.csv")

# interaction effects

int_effects = pd.concat([

GetInts(vec1=dat["acc"], vecname1="acc", scaling1=rho_factor_list["acc"],

vec2=dat["dev"], vecname2="dev", scaling2=rho_factor_list["dev"],

nperiods=num_periods, train_ind=dat["train_ind"]),

GetInts(vec1=dat["dev"], vecname1="dev", scaling1=rho_factor_list["dev"],

vec2=dat["cal"], vecname2="cal", scaling2=rho_factor_list["cal"],

nperiods=num_periods, train_ind=dat["train_ind"]),

GetInts(vec1=dat["acc"], vecname1="acc", scaling1=rho_factor_list["acc"],

vec2=dat["cal"], vecname2="cal", scaling2=rho_factor_list["cal"],

nperiods=num_periods, train_ind=dat["train_ind"])

],

axis="columns")The table looks like this:

int_effects| I_acc_ge_2xI_dev_ge_2 | I_acc_ge_2xI_dev_ge_3 | I_acc_ge_2xI_dev_ge_4 | I_acc_ge_2xI_dev_ge_5 | I_acc_ge_2xI_dev_ge_6 | I_acc_ge_2xI_dev_ge_7 | I_acc_ge_2xI_dev_ge_8 | I_acc_ge_2xI_dev_ge_9 | I_acc_ge_2xI_dev_ge_10 | I_acc_ge_2xI_dev_ge_11 | ... | I_acc_ge_39xI_cal_ge_30 | I_acc_ge_39xI_cal_ge_31 | I_acc_ge_39xI_cal_ge_32 | I_acc_ge_39xI_cal_ge_33 | I_acc_ge_39xI_cal_ge_34 | I_acc_ge_39xI_cal_ge_35 | I_acc_ge_39xI_cal_ge_36 | I_acc_ge_39xI_cal_ge_37 | I_acc_ge_39xI_cal_ge_38 | I_acc_ge_39xI_cal_ge_39 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 1 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 2 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 3 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 4 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 1595 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | ... | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 |

| 1596 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | ... | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 |

| 1597 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | ... | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 |

| 1598 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | ... | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 |

| 1599 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | ... | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 | 0.010989 |

1600 rows × 3629 columns

# Export to file for debugging

# int_effects.to_csv("int_effects_py.csv")

varset = pd.concat([main_effects, int_effects], axis="columns")

varset_train = varset.loc[dat.train_ind]

# drop any constant columns over the training data set

# do this by identifying the constant columns and dropping them

keep_cols = (varset != varset.iloc[0]).any()

varset = varset.loc[:, keep_cols]

varset_train = varset_train.loc[:, keep_cols]

# now add these variables into an extended data object

# remove anything not used in modelling

dat_plus = pd.concat(

[

dat[["pmts", "train_ind"]],

varset

],

axis="columns")Setup for LASSO

First we need to set up the data for the model. This differs from the tree-based models task as follows in that the input variables are all the basis functions we created and not the raw accident / development / calendar quarter terms - the dat_plus data.table.

X_train_plus = varset[dat.train_ind]

X_test_plus = varset.loc[dat.train_ind == False]

X_plus = varsetDIY GLMnet with Pytorch

The results will not be identical to those in the paper since the Python implementation is different and uses different hyper-parameters.

We want to use GLM with LASSO regularization and CV, but at the time of writing, the implementation in scikit-learn has major limitations.

The PoissonRegressor does not have “warm restarts” which allows re-using the coefficients as it tests through different regularisation factors, so CV is slow. More importantly, its alpha regularization parameter is a l2 ridge regression penalty, not the l1 LASSO penalty.

As far as alternatives go, the following are unlikely to meet our needs:

statsmodelsseemed incredibly slow in our early experiments, taking over a day to train a single model on this data.pyglmnetalso seemed incredibly slow.glmnet_pyrequires Linux. It should in theory run via Google Colab or Windows Subsystem for Linux as well, but for this particular tutorial we wanted to share a multi-platform solution.python-glmnetonly implements linear and logistic regression.

Our options seem to be using the cluster computing framework h2o.ai or creating our own LASSO using a neural network framework like pytorch.

Both seem a little overkill but, but since we’re planning to cover more on neural networks in future articles, we can use pytorch to introduce some concepts here.

Firstly we will just import pytorch. If you are running this on your pc and have a GPU you would like to utilise, make sure you install the right version for best performance.

import torch

import torch.nn as nn

from torch.distributions import Normal, OneHotCategorical

import torch.nn.functional as F

torch.manual_seed(0)

from sklearn.base import BaseEstimator, RegressorMixin

from sklearn.utils.validation import check_X_y, check_array, check_is_fittedFirst we will create a Pytorch Module for the GLM. This is pretty straightforward - a neural network with no hidden layers is a LM, and by applying an exponential to the output, we have a log-link GLM.

class LogLinkGLM(nn.Module):

# Define the parameters in __init__

def __init__(

self,

n_input=3): # number of inputs

super(LogLinkGLM, self).__init__()

self.linear = torch.nn.Linear(n_input, 1) # These will be the coefficients

nn.init.zeros_(self.linear.weight) # Initialise these to zero

# forward defines how you get y from X.

def forward(self, x):

return torch.exp(self.linear(x)) # log(Y) = XB -> Y = exp(XB)Next, to fit it within our scikit-learn framework, we will make a scikit-learn Regressor. The key components are:

__init__: Define any hyperparameters here. At a minimum, this would include the lasso regularization penalty.fit: Define the training process for the model. Forpytorchwe have a training loop where we read data, calculated the loss, backpropogate it and update the weights.predict: Define how to get predictions - i.e. apply theforwardmethod of the Module.score: Define performance. Here we will use RMSE for consistency with the notebook.

There is also some added boilerplate about getting data into the right format.

class LogLinkGLMNetRegressor(BaseEstimator, RegressorMixin):

def __init__(

self,

l1_penalty=0.0, # lambda is a reserved word

weight_decay=0.0,

max_iter=200000,

lr=0.01,

min_improvement=0.01,

check_improvement_every_iter=5000,

patience=3,

init_weight=None,

init_bias=None,

verbose=1,

target_device=torch.device("cuda") if torch.cuda.is_available() else torch.device("cpu")):

""" Log Link GLM LASSO Regressor

This trains a GLM with Poisson loss, Log Link and l1 LASSO penalties

using Pytorch. It has early stopping

Note:

Do not include the `self` parameter in the ``Args`` section.

Args:

l1_penalty (float): l1 penalty factor (we use l1_penalty because lambda is

a reserved word in Python for anonymous functions)

weight_decay (float): weight decay - analogous to l2 penalty factor

max_iter (int): Maximum number of epochs before training stops

lr (float): Learning rate

min_improvement (float), patience (int), check_improvement_every_iter (int):

RMSE must improve by this percent otherwise patience will decrement.

Once patience reaches zero, training stops.

verbose (int): 0 means don't print. 1 means do print.

init_weight, init_bias (torch tensor): initial weight (coefficient)

and bias (intercept) for a warm start.

"""

self.l1_penalty = l1_penalty

self.weight_decay = weight_decay

self.max_iter = max_iter

self.target_device = target_device

self.min_improvement = min_improvement

self.lr = lr

self.patience = patience

self.init_weight = init_weight

self.init_bias = init_bias

self.check_improvement_every_iter = check_improvement_every_iter

self.verbose = verbose

def fit(self, X, y):

# Check that X and y have correct shape

X, y = check_X_y(X, y)

# Skorch is picky about format

if isinstance(X, pd.DataFrame) or isinstance(X, pd.Series):

X = X.values

if isinstance(y, pd.DataFrame) or isinstance(y, pd.Series):

y = y.values

# Convert to Pytorch Tensor

X_tensor = torch.from_numpy(X.astype(np.float32)).to(self.target_device)

y_tensor = torch.from_numpy(y.astype(np.float32)).reshape(-1, 1).to(self.target_device)

n_input = X.shape[-1]

self.module_ = LogLinkGLM(n_input=n_input).to(self.target_device)

# Set initial weight

if self.init_weight is not None:

self.module_.linear.weight.data = self.init_weight

# Set initial intercept

if self.init_bias is not None:

self.module_.linear.bias.data = self.init_bias

else:

# To something close so gradients do not explode

avg_log_y = np.log(np.mean(y))

self.module_.linear.bias.data = torch.tensor([avg_log_y])

optimizer = torch.optim.AdamW(

params=self.module_.parameters(),

lr=self.lr,

weight_decay=self.weight_decay

)

loss_fn = nn.PoissonNLLLoss(log_input=False).to(self.target_device)

last_rmse = -1

patience = self.patience

# Training loop

for epoch in range(self.max_iter): # Repeat max_iter times

y_pred = self.module_(X_tensor) # Apply current model

loss = loss_fn(y_pred, y_tensor) # What is the loss on it?

loss += self.l1_penalty * self.module_.linear.weight.abs().sum() # lasso

optimizer.zero_grad() # Reset optimizer

loss.backward() # Apply back propagation

optimizer.step() # Update model parameters

# Every 5,000 steps (or setting) get RMSE

if epoch % self.check_improvement_every_iter == 0:

rmse = torch.sqrt(torch.mean(torch.square(y_pred - y_tensor)))

if self.verbose > 0:

print("Train RMSE: ", rmse.data.tolist()) # Print loss

# Stop if not

if rmse.data.tolist() > last_rmse * (1 - self.min_improvement):

patience += -1

if patience == 0:

if self.verbose > 0:

print("Insufficient improvement found, stopping training")

break

last_rmse = rmse.data.tolist()

# Return the regressor

return self

def predict(self, X):

# Check is fit had been called

check_is_fitted(self)

# Input validation

X = check_array(X)

# Skorch is picky about format

if isinstance(X, pd.DataFrame) or isinstance(X, pd.Series):

X = X.values

# Convert to Pytorch Tensor

X_tensor = torch.from_numpy(X.astype(np.float32)).to(self.target_device)

# Apply current model and return

return self.module_(X_tensor).cpu().detach().numpy().ravel()

def score(self, X, y):

# Negative RMSE score (higher needs to be better)

y_pred = self.predict(X)

return -np.sqrt(np.mean((y_pred - y)**2))Previous best fit

So, can we replicate the previously tuned model from R in Python?

tic = time.perf_counter()

lasso_prev = LogLinkGLMNetRegressor(l1_penalty=7674)

lasso_prev.fit(X_train_plus, y_train)

toc = time.perf_counter()

print(f"Ran in {toc - tic:0.4f} seconds")Train RMSE: 428498688.0 Train RMSE: 53182680.0 Train RMSE: 52894192.0 Train RMSE: 48454752.0 Train RMSE: 47999504.0 Insufficient improvement found, stopping training Ran in 64.2999 seconds

Cross Validation

With our new Regressor we can now do CV with something that resembles warm starts by putting an initial fit (here we will recycle the previous best GLM from R) as the starting weights for the search.

The key parameter to tune in lasso is the regularisation penalty. With glmnet in R and in most academic literature, this is typically called lambda. However, with scikit-learn in Python, with lambda being a reserved keyword for anonymous functions, we will call the same parameter l1_penalty.

With our DIY “semi warm start” the training is faster but still takes a while. To keep a reasonable running time for running the example we will keep it to ten runs near the optimal lambda from the R run, but if we were building the model from scratch we would be testing many more values of lambda.

If running time is a critical factor and it is taking too long, three considerations: 1. pytorch runs faster with a GPU, 2. You can get much smarter with the warm start logic. 3. You can also consider the GLM implementation in the h2o.ai package mentioned earlier which is quite fast.

lambdas = [np.exp(0.1 * x) for x in range(86, 96)]

lambdas[5431.659591362978, 6002.912217261029, 6634.24400627789, 7331.973539155995, 8103.083927575384, 8955.292703482508, 9897.129058743927, 10938.019208165191, 12088.380730216988, 13359.726829661873]

parameters_lasso = {

"l1_penalty": lambdas,

"init_weight": [lasso_prev.module_.linear.weight.data],

"init_bias": [lasso_prev.module_.linear.bias.data],

"lr": [0.001], # Fine tuning?

"check_improvement_every_iter": [100],

"verbose": [0]

}

tic = time.perf_counter()

# N.b. this will not run in parallel.

lasso = GridSearchCV(

LogLinkGLMNetRegressor(),

parameters_lasso,

verbose=1)

lasso.fit(X_train_plus, y_train)

toc = time.perf_counter()

print(f"Ran in {toc - tic:0.4f} seconds")Fitting 5 folds for each of 10 candidates, totalling 50 fits Ran in 34.7665 seconds

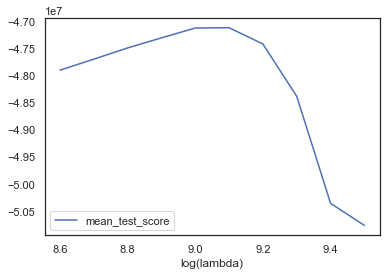

Let’s plot the test error vs different regularisation parameters:

# Check the path includes a minimum value of error

pd.DataFrame({

"log(lambda)": [np.log(p["l1_penalty"]) for p in lasso.cv_results_["params"]],

"mean_test_score": lasso.cv_results_["mean_test_score"]

}).plot(x="log(lambda)", y="mean_test_score")<AxesSubplot:xlabel='log(lambda)'>

print("Best regularisation parameter [log(lambda)] was:")

print(np.log(lasso.best_estimator_.get_params()["l1_penalty"]))Best regularisation parameter [log(lambda)] was:

9.1

# Get the best fit:

lasso.best_estimator_.get_params(){'check_improvement_every_iter': 100,

'init_bias': tensor([15.3488]),

'init_weight': tensor([[-1.1317e+00, -8.1524e-01, -5.3453e-01, ..., 1.3915e-04,

1.3895e-04, 1.3895e-04]]),

'l1_penalty': 8955.292703482508,

'lr': 0.001,

'max_iter': 200000,

'min_improvement': 0.01,

'patience': 3,

'target_device': device(type='cpu'),

'verbose': 0,

'weight_decay': 0.0}We arrive back at the original value of lambda.

Model analysis

This is the interesting bit - let’s look at all the models to see how they’ve performed (but remember not to draw too many conclusions about model performance from this example as discussed earlier!).

Consolidate results

Now we will consolidate results for these models. We will gather together:

- RMSE for past and future data

- predictions for each model.

Note that scikit-learn has various tuning tools which we haven’t used here yet - partially because we want to focus on the concepts rather than the code and partially because we want to compare the results to a couple of other models not fitted in the same framework. If you’re interested in learning more then the section on tuning in the documentation is a good start.

First, we’ll set up a data frame to hold the model projections for each model and populate these projections for each model

# Dataset of all forecasts

model_forecasts = dat.copy()

model_forecasts["Decision Tree"] = grid_tree.best_estimator_.predict(X)

model_forecasts["Random Forest"] = grid_forest.best_estimator_.predict(X)

model_forecasts["Classic GBM"] = grid_gbm.best_estimator_.predict(X)

model_forecasts["Histogram GBM"] = grid_hgbm.best_estimator_.predict(X)

model_forecasts["Hist GBM (prev)"] = gbm_prev.predict(X)

model_forecasts["Neural Network"] = neural_network.predict(X)

model_forecasts["Chain Ladder"] = chain_ladder.predict(X)

model_forecasts["LASSO"] = lasso.predict(X_plus)

model_forecasts["LASSO (prev)"] = lasso_prev.predict(X_plus)Here’s how our collated forecast DataFrame looks so far:

model_forecasts| pmts | acc | dev | cal | mu | train_ind | accf | devf | Decision Tree | Random Forest | Classic GBM | Histogram GBM | Hist GBM (prev) | Neural Network | Chain Ladder | LASSO | LASSO (prev) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2.426712e+05 | 1.0 | 1.0 | 1.0 | 7.165313e+04 | True | 0 | 0 | 2.426712e+05 | 1.887456e+05 | 6.014116e+06 | 3.500558e+04 | 4.569216e+04 | 2.034437e+04 | 3.585367e+04 | 4633215.0 | 4641892.5 |

| 1 | 1.640013e+05 | 1.0 | 2.0 | 2.0 | 1.042776e+06 | True | 0 | 1 | 1.640013e+05 | 2.087371e+05 | 6.072307e+06 | 5.235618e+05 | 7.127655e+05 | 2.364422e+05 | 1.234291e+06 | 5844869.0 | 5853403.5 |

| 2 | 3.224478e+06 | 1.0 | 3.0 | 3.0 | 4.362600e+06 | True | 0 | 2 | 3.224478e+06 | 3.578825e+06 | 6.259892e+06 | 2.676693e+06 | 2.217522e+06 | 2.121035e+06 | 3.324359e+06 | 8970644.0 | 8977765.0 |

| 3 | 3.682531e+06 | 1.0 | 4.0 | 4.0 | 1.095567e+07 | True | 0 | 3 | 3.682531e+06 | 5.627768e+06 | 9.945203e+06 | 5.691426e+06 | 5.253524e+06 | 4.810498e+06 | 8.746143e+06 | 15132947.0 | 15134997.0 |

| 4 | 1.014937e+07 | 1.0 | 5.0 | 5.0 | 2.080055e+07 | True | 0 | 4 | 1.014937e+07 | 1.605141e+07 | 2.417595e+07 | 1.582105e+07 | 1.564311e+07 | 1.021459e+07 | 1.715827e+07 | 24922094.0 | 24914536.0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 1595 | 6.265737e+07 | 40.0 | 36.0 | 75.0 | 8.285330e+07 | False | 39 | 35 | 3.276252e+09 | 3.088414e+09 | 2.819504e+09 | 3.895124e+08 | 3.132752e+08 | 1.119816e+08 | 2.794976e+08 | 155724928.0 | 140357952.0 |

| 1596 | 6.346768e+07 | 40.0 | 37.0 | 76.0 | 6.268272e+07 | False | 39 | 36 | 3.276252e+09 | 3.088414e+09 | 2.819504e+09 | 3.895124e+08 | 3.132752e+08 | 1.005221e+08 | 1.896219e+09 | 200310144.0 | 182843872.0 |

| 1597 | 2.604198e+07 | 40.0 | 38.0 | 77.0 | 4.722784e+07 | False | 39 | 37 | 3.276252e+09 | 3.088414e+09 | 2.819504e+09 | 3.895124e+08 | 3.132752e+08 | 9.023538e+07 | 4.350021e+08 | 257674688.0 | 238155184.0 |

| 1598 | 3.394727e+07 | 40.0 | 39.0 | 78.0 | 3.544488e+07 | False | 39 | 38 | 3.276252e+09 | 3.088414e+09 | 2.819504e+09 | 3.895124e+08 | 3.132752e+08 | 8.100099e+07 | 5.732754e+09 | 331492544.0 | 310216256.0 |

| 1599 | 3.725869e+07 | 40.0 | 40.0 | 79.0 | 2.650330e+07 | False | 39 | 39 | 3.276252e+09 | 3.088414e+09 | 2.819504e+09 | 3.895124e+08 | 3.132752e+08 | 7.271181e+07 | 6.280085e+08 | 426433856.0 | 404176352.0 |

1600 rows × 17 columns

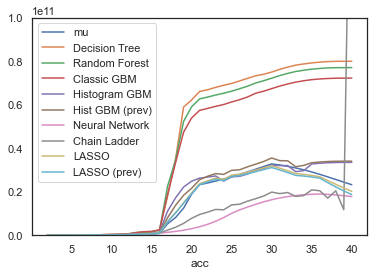

RMSE

We are going to do these calculations by using the scikit-learn benchmark tools. Since the LASSO model is the only one using the plus datasets, we will use that as the starting example

# Empty list to store results.

scikit_results = []

y_predicted_full_results = {}

y_predicted_test_results = {"Actuals": y_test}

# LASSO uses the "plus" datasets

# Train:

y_predicted_train = lasso.predict(X_train_plus)

train_rmse = mean_squared_error(y_train, y_predicted_train, squared=False)

# Test:

y_predicted_test = lasso.predict(X_test_plus)

test_rmse = mean_squared_error(y_test, y_predicted_test, squared=False)

# Append to the list of results.

y_predicted_full_results["LASSO"] = lasso.predict(X_plus)

y_predicted_test_results["LASSO"] = y_predicted_test

scikit_results += [{

"Name": "LASSO",

"Train RMSE": train_rmse,

"Test RMSE": test_rmse

}]

# LASSO (prev) also uses the "plus" datasets

# Train:

y_predicted_train = lasso_prev.predict(X_train_plus)

train_rmse = mean_squared_error(y_train, y_predicted_train, squared=False)

# Test:

y_predicted_test = lasso_prev.predict(X_test_plus)

test_rmse = mean_squared_error(y_test, y_predicted_test, squared=False)

# Append to the list of results.

y_predicted_full_results["LASSO (prev)"] = lasso_prev.predict(X_plus)

y_predicted_test_results["LASSO (prev)"] = y_predicted_test

scikit_results += [{

"Name": "LASSO (prev)",

"Train RMSE": train_rmse,

"Test RMSE": test_rmse

}]and then for the rest we put it in a loop running on the “non-plussed” datasets:

# Using zip in a for loop means pipe and name will run through

# the tuples of the two lists in that order.

for pipe, name in zip(

[grid_tree.best_estimator_, grid_forest.best_estimator_, grid_gbm.best_estimator_,

grid_hgbm.best_estimator_, gbm_prev, neural_network, chain_ladder],

["Decision Tree", "Random Forest", "Classic GBM", "Histogram GBM", "Hist GBM (prev)", "Neural Network", "Chain Ladder"]

):

y_predicted_train = pipe.predict(X_train)

train_rmse = mean_squared_error(y_train, y_predicted_train, squared=False)

y_predicted_test = pipe.predict(X_test)

test_rmse = mean_squared_error(y_test, y_predicted_test, squared=False)

y_predicted_full_results[name] = pipe.predict(X)

y_predicted_test_results[name] = y_predicted_test

scikit_results += [{

"Name": name,

"Train RMSE": train_rmse,

"Test RMSE": test_rmse

}]Let’s have a look at these results for past and future data sets with results ranked by test RMSE.

df_results = pd.DataFrame(scikit_results).sort_values("Test RMSE")

pd.set_option('display.float_format', '{0:,.0f}'.format)

display(df_results)+—+—————–+————-+—————+ | | Name | Train RMSE | Test RMSE | +===+=================+=============+===============+ | 0 | LASSO | 48,283,020 | 252,009,808 | +—+—————–+————-+—————+ | 1 | LASSO (prev) | 49,082,112 | 269,974,336 | +—+—————–+————-+—————+ | 6 | Hist GBM (prev) | 40,110,165 | 313,377,932 | +—+—————–+————-+—————+ | 5 | Histogram GBM | 34,464,022 | 455,524,543 | +—+—————–+————-+—————+ | 7 | Neural Network | 274,930,720 | 930,978,112 | +—+—————–+————-+—————+ | 4 | Classic GBM | 42,979,008 | 1,603,949,161 | +—+—————–+————-+—————+ | 8 | Chain Ladder | 138,528,934 | 1,722,351,650 | +—+—————–+————-+—————+ | 3 | Random Forest | 30,698,739 | 1,789,873,775 | +—+—————–+————-+—————+ | 2 | Decision Tree | 0 | 1,916,509,816 | +—+—————–+————-+—————+

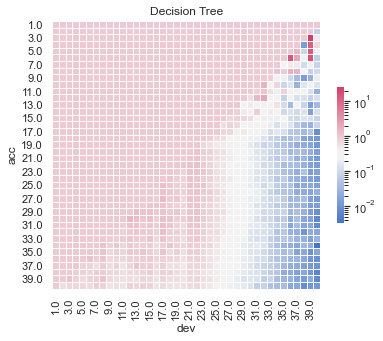

The key indicator is performance on a hold-out data set, in this case the future data. Otherwise, looking at Train RMSE, the decision tree would be perfect, having overfit the data to a loss of zero.

For the future data, we see a very different story. As expected, the tuned decision tree does appear to be over-fitted, performing the worst.

The LASSO model performs the best. The CV tuned model is pretty similar to the previous model from the R run.

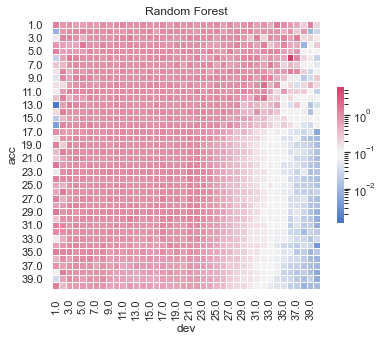

The histogram GBM model follows. The “previously tuned” version has essentially identical performance to the XGBoost model from the R version of this article.

The simple neural network follows that.

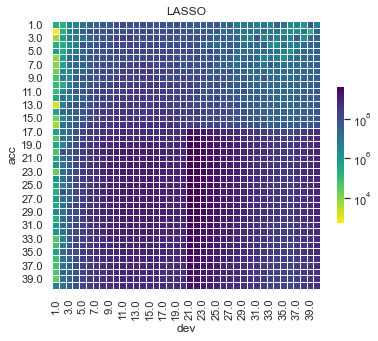

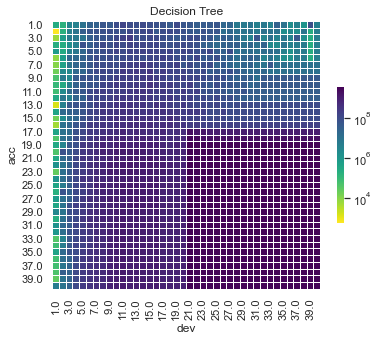

Visualising the fit

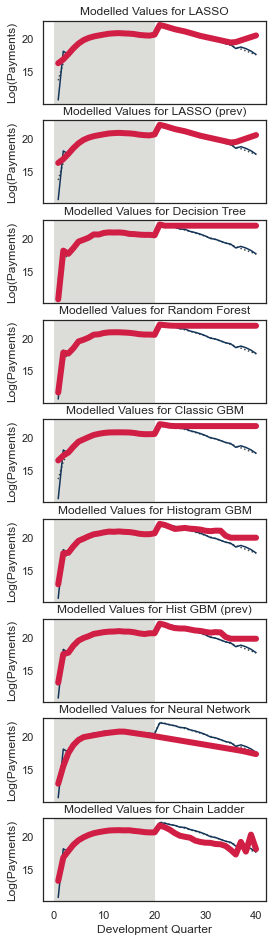

Although useful, the RMSE is just a single number so it’s helpful to visualise the fit. In particular, because these are models for a reserving data set, we can take advantage of that structure when analysing how well each model is performing.

Fitted values

First, lets show visualise the fitted payments. The graphs below show the log(fitted values), or log(payments) in the case of the actual values.

for name, y_pred in y_predicted_test_results.items():

# Skip prev models - these are similar enough to last version

if name not in ["LASSO (prev)", "Hist GBM (prev)"]:

# Plot

dat_ = dat.copy()

dat_.loc[dat_.train_ind == False, "pmts"] = y_pred

plot_triangle(

dat_.pivot(index="acc", columns="dev", values="pmts"),

mask_bottom=False,

title=name

)

plt.show()

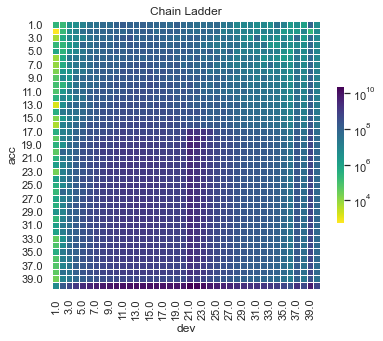

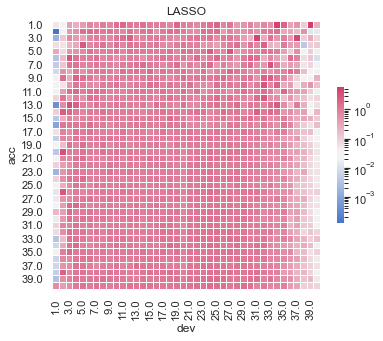

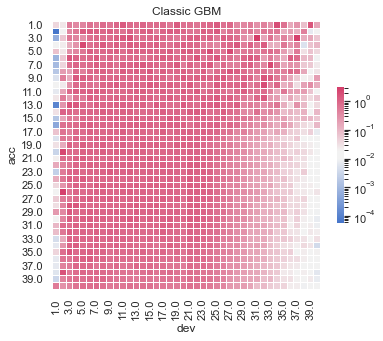

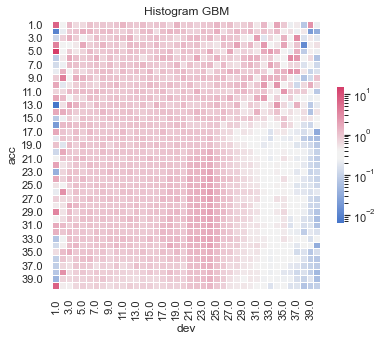

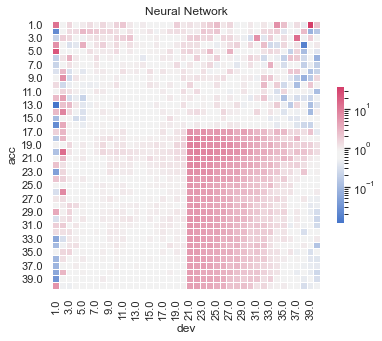

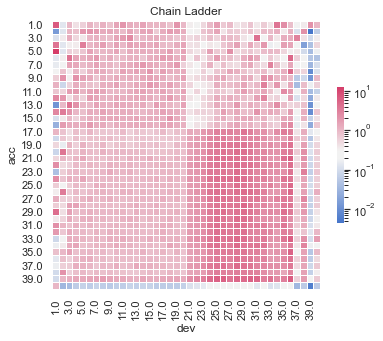

Some things are apparent from this:

- The lack of interactions or diagonal effects in the Chain ladder

- All the machine learning models do detect and project the interaction

- The blocky nature of the decision tree and the overfit to the past data

- The random forest and GBMs fit look smoother since they are a function of a number of trees.

- The LASSO and neural network fits are the smoothest, which is not surprising since it consists of continuous functions.

- Visually, the LASSO seems to capture the interaction the best.

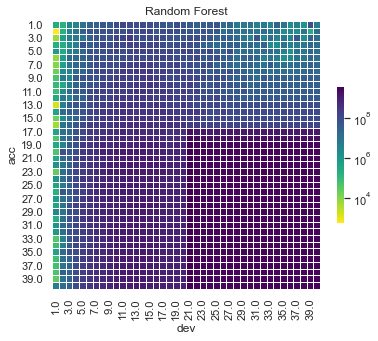

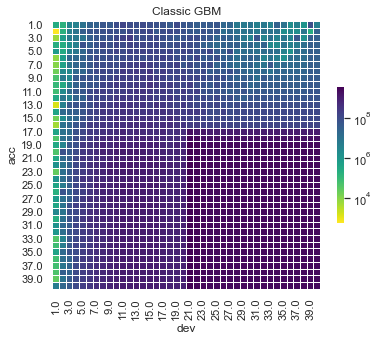

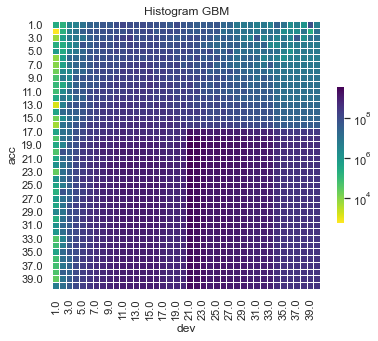

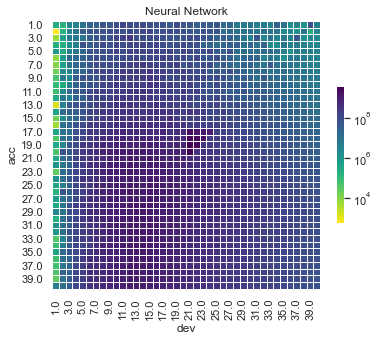

Actual vs Fitted heat maps

We can also look at the model fits via heat maps of the actual/fitted values.

For triangular reserving data, these types of plots are very helpful when examining plot fit.

First, here’s a function to draw the heatmaps.

for name, y_pred in y_predicted_full_results.items():

# Skip prev models - these are similar enough to last version

if name not in ["LASSO (prev)", "Hist GBM (prev)"]:

# Plot

dat_ = dat.copy()

dat_["pmts_ratio"] = dat_.pmts / y_pred

cmap = sns.diverging_palette(255,0,sep=16, as_cmap=True) # to be similar to R colouring

plot_triangle(

dat_.pivot(index="acc", columns="dev", values="pmts_ratio"),

mask_bottom=False,

title=name,

cmap=cmap # vlag also not a bad palette for this

)

plt.show()

All models have shortcomings, but the LASSO and previously tuned XGBoost models outperform the others.

Quarterly tracking

Finally, we will look at the predictions for specific parts of the data set. Quarterly tracking graphs:

- Plot the actual and fitted payments, including future values, by one of accident / development / calendar period

- Hold one of the other triangle directions fixed, meaning that the third direction is then determined.

- Additionally plot the underlying mean from which the data were simulated.

We’ll use a couple of functions because we want to do this repeatedly.

The first function (GraphModelVals) is from the blog on the LASSO model, and draws a single tracking graph. The second function (QTracking) generates the graphs for all models and uses the patchwork package to wrap them into a single plot.

Let’s have a look at the tracking for accident quarter when development quarter = 5. We’ll wrap this in another function since we want to call this for a few different combinations.

model_names = [x["Name"] for x in scikit_results if name not in ["LASSO (prev)", "Hist GBM (prev)"]]

def QTrack(model_forecasts, model_names, period_to_filter, period, total_num_periods, plot_mu=True):

"""

Plots model vs payments and mu

Args:

model_forecasts: Pandas DataFrame. Should have dev, acc, mu, pmts

model_names: List of model names to plot Should be columns in model_forecasts

period_to_filter: "dev" or "acc". The period to filter by

period: integer. filter value for period_to_filter. I.e. period_to_filter="acc", period=5 filters for acc=5.

total_num_periods: total number of periods. First total_num_periods - period periods are greyed out.

"""

fig, axs = plt.subplots(len(model_names), 1, sharex=True, figsize=(4, 1.8 * len(model_names)))

other_period = [x for x in ["dev", "acc"] if x != period_to_filter][0]

for model_name, ax in zip(model_names, axs):

# Shade historical quarters

ax.axvspan(0, total_num_periods - period, facecolor=plot_colors["lgrey"])

# Plot mu

if plot_mu:

ax.plot(

model_forecasts.loc[model_forecasts[period_to_filter] == period, other_period].values,

np.log(model_forecasts.loc[model_forecasts[period_to_filter] == period, "mu"].values),

color=plot_colors["dgrey"],

linestyle=':')

# Plot Payments

ax.plot(

model_forecasts.loc[model_forecasts[period_to_filter] == period, other_period].values,

np.log(model_forecasts.loc[model_forecasts[period_to_filter] == period, "pmts"].values),

color=plot_colors["dblue"])

# Plot model

ax.plot(

model_forecasts.loc[model_forecasts[period_to_filter] == period, other_period].values,

np.log(model_forecasts.loc[model_forecasts[period_to_filter] == period, model_name].values),

color=plot_colors["red"],

linewidth=6)

ax.set_ylabel('Log(Payments)')

ax.set_title(f'Modelled Values for {model_name}')

if period_to_filter == "acc":

ax.set_xlabel('Development Quarter')

else:

ax.set_xlabel('Accident Quarter')

plt.show()

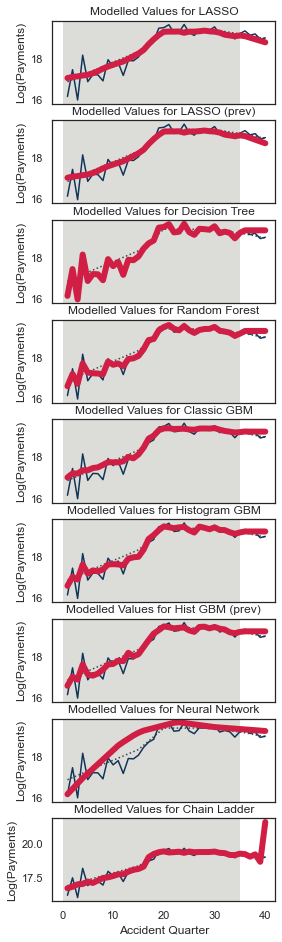

QTrack(model_forecasts, model_names, period_to_filter="dev", period=5, total_num_periods=num_periods)

Because this is mostly old data and because it is not affected by the interaction, the tracking should be generally good.

That being said, the predictions are a bit all over the place.

The decision tree, random forest and classic GBM seem underfit, as does the neural network. The histogram GBM is decent, slightly overfit. The Chain Ladder final quarter is a bit wild as can happen with a Chain Ladder. The LASSO model is a bit rough - especially if compared to the fit from the R implementation - but isn’t too bad.

Here are a few more tracking plots to help further illustrate the model fits.

Tracking for accident quarter when development quarter = 24

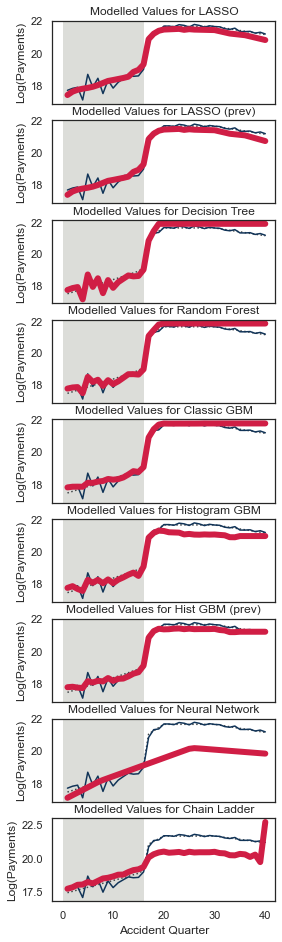

QTrack(model_forecasts, model_names, period_to_filter="dev", period=24, total_num_periods=num_periods)

Development quarter 24 is impacted by the interactions for accident quarters>17.

LASSO and the histogram GBM reflects this the best. The other tree models extrapolate a flat curve, whilst the neural network continues an upward trend. The Chain Ladder overpredicts the last value.

Tracking for accident quarter when development quarter = 35

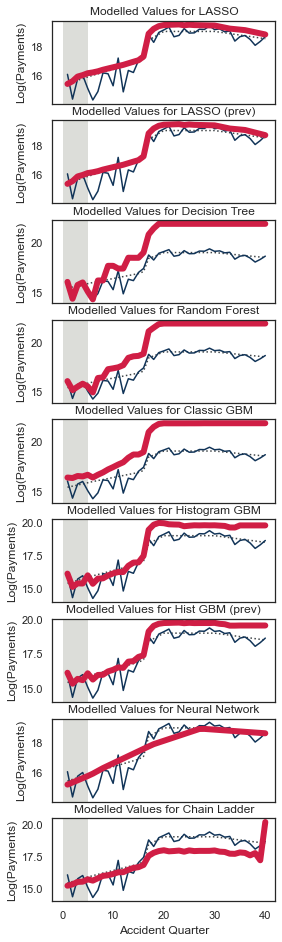

QTrack(model_forecasts, model_names, period_to_filter="dev", period=35, total_num_periods=num_periods)

This is quite hard for the models since most of the values are in the future. The neural network fits a smooth curve. The histogram GBM and the LASSO work well here.

We can look at similar plots by development quarter for older and newer accident quarters

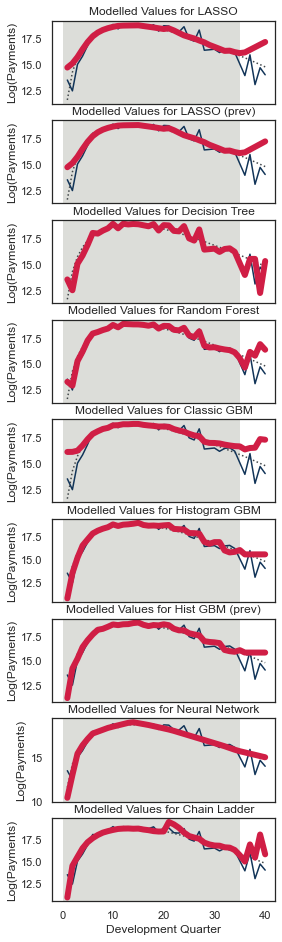

Tracking for development quarter when accident quarter = 5

QTrack(model_forecasts, model_names, period_to_filter="acc", period=5, total_num_periods=num_periods)